Property Tax Cut - Real or Scam?

Lol, c’mon you know better.

After years of “property tax relief” scams, where politicians claimed they lowered taxes but your tax bill still went up, it does appear that most Texas homeowners will be getting a substantial property tax cut.

Gov. Greg Abbott has signed an $18 billion tax cut for Texas property owners, sending the proposals to voters for their approval later this year.

The package puts $12.6 billion of the state’s historic budget surplus toward making cuts to school taxes for all property owners, dropping property taxes an average of more than 40% for some 5.7 million Texas homeowners and offering brand-new tax savings for smaller businesses and other commercial and nonhomesteaded properties.

The budget surplus was $32.7 billion, they have decided to give us $12.6 billion back.

Why was the surplus so large?

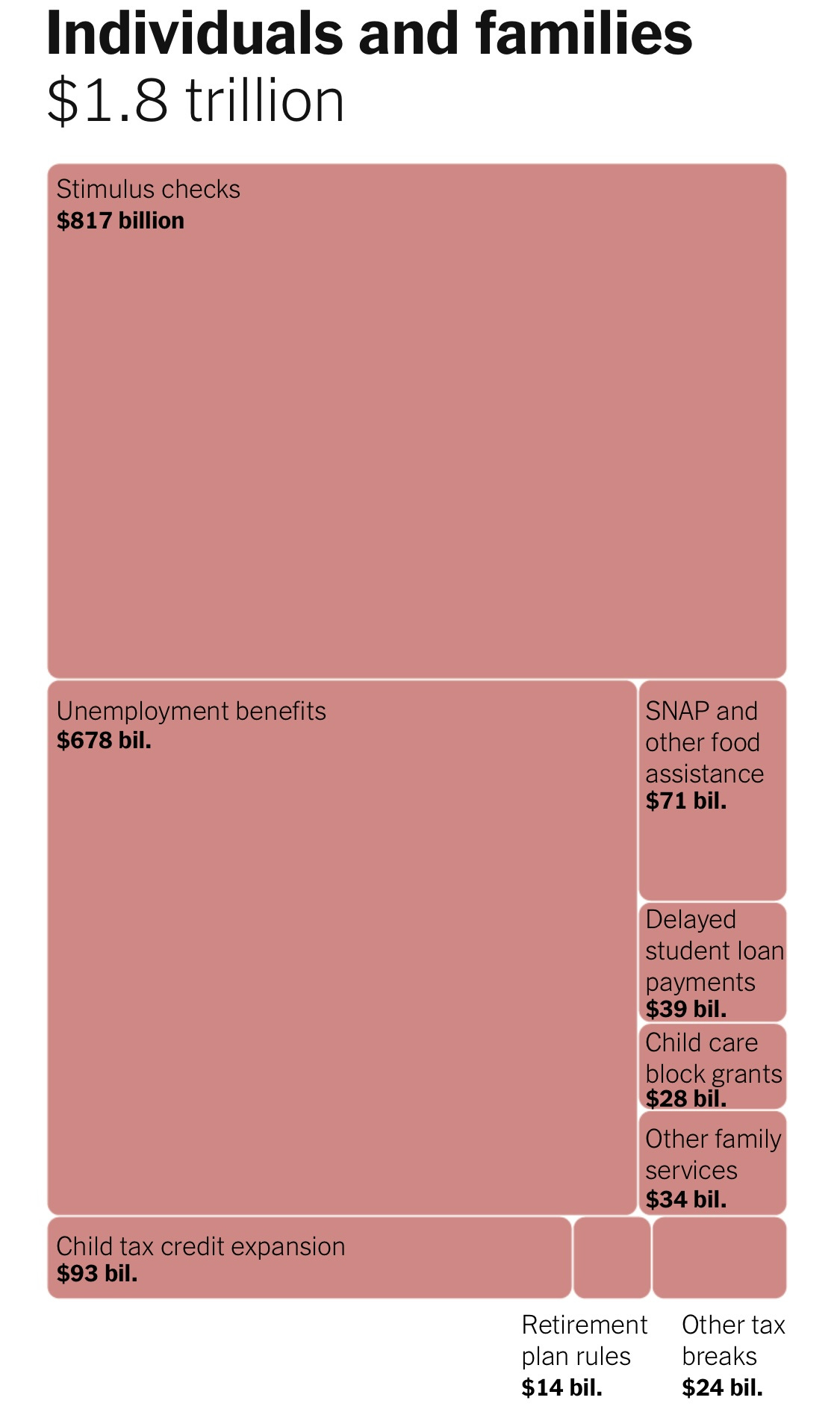

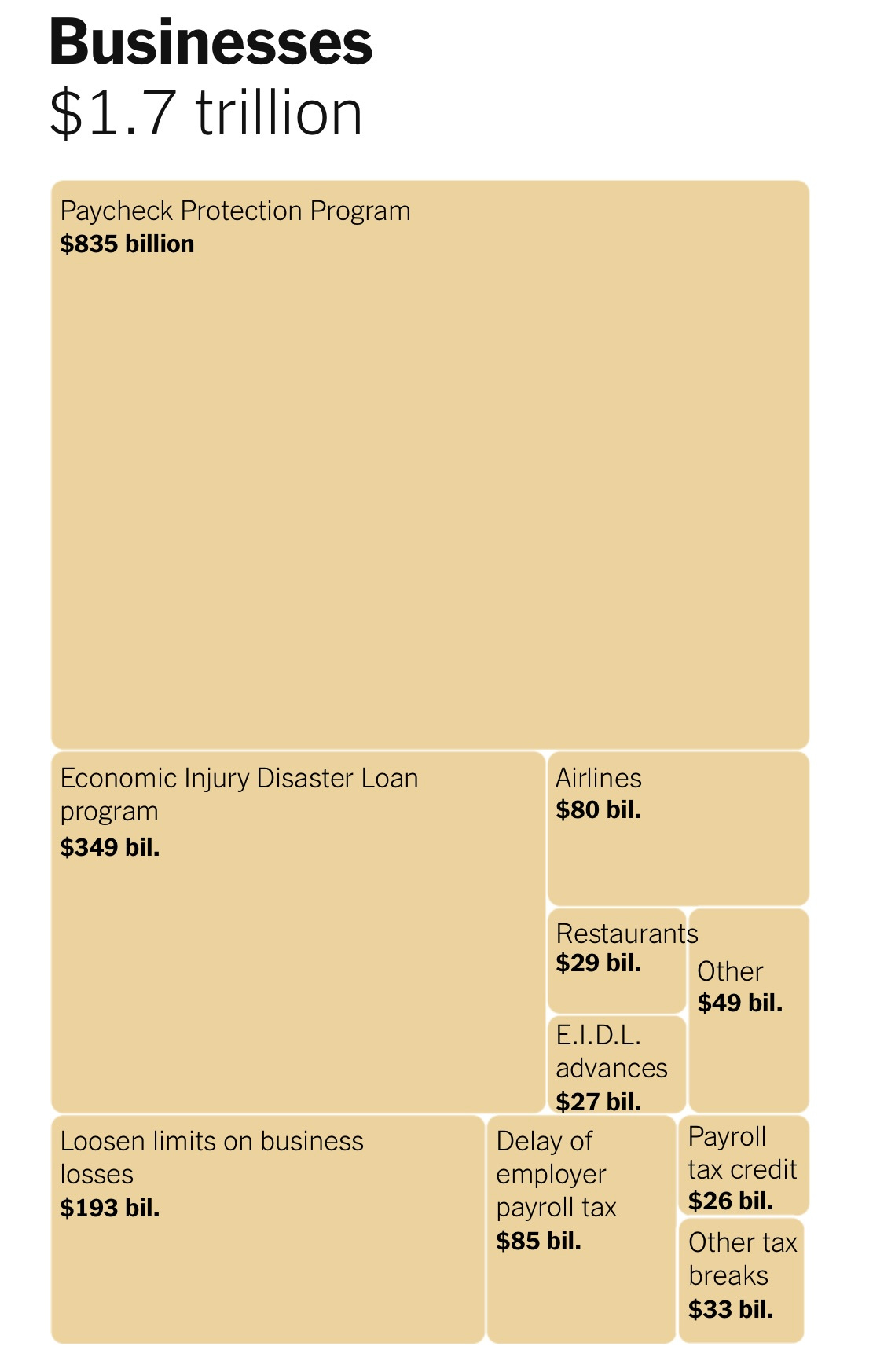

The Tribune article includes this helpful graphic to illustrate what happened.

You’ll notice a sudden and sharp increase in tax revenue starting in 2021.

What happened starting in 2020-21?

Yes, the budget surplus is the result of the money printing bonanza that was a part of the government’s response to a flu virus that “killed” 80 year-olds.

Nearly all elected Republicans played along with the Covid hoax and its destructive effects for 2 full years.

Now, they want us to forget!

To recap here:

Republicans locked down Texas during the Covid-19 hoax, masks and all

Texas businesses were forced to close (except multinational corporations)

Denying people the ability to earn a living, the government necessarily gave people cash to live

$5 trillion is handed out

Texas sees a large increase in tax revenue

Texas Republicans return 39% of the surplus

This money from this Texas surplus was obtained via fraud, and we are supposed to be thankful that 39% of these ill-gotten gains are being returned?

This is absurd on its face, but it’s actually much worse than it appears.

It appears likely that most taxpayers will see their tax bill decrease by a considerable amount, at least temporarily. This fact will not be lost on voters, because this tax cut requires voters to give its final approval in the November 2023 election!

A third measure, House Joint Resolution 2, will go before voters in a constitutional election in November. Voters would need to approve the package for the cuts to take effect this year.

This tax cut, fresh on the minds of voters, will be a key campaign point for incumbents seeking re-election. These are largely the same officials who initiated the COVID lockdown, leading to the series of events described above. Should that matter?

This also begs the question, if right-wingers want to challenge incumbents by running candidates who will stand for something, what exactly is the plan here? Are you going to tell voters their tax cut “wasn’t big enough?”

What a disaster. They’ve really got us.

Anyway, this is something you need to know.

POShaheen in the masks are a clear indicator of what type of legislator he is. Once a Freedom Caucus member held in high regard reduced down to a sheep of a Rep that rides Jared Pattersons coat tails.